As cyber threats continue to evolve, the cyber insurance landscape is adapting to address emerging risks and regulatory changes. Understanding the current requirements and implementing best practices not only enhances your organization’s security posture but can also lead to more favorable insurance premiums—especially when it comes to cyber insurance for small businesses.

Emerging Requirements for Cyber Insurance for Small Businesses

Insurers are placing increased emphasis on specific security measures to mitigate the rising tide of cyber incidents. This is particularly relevant to cyber insurance for small businesses, where even a single breach can result in devastating financial and reputational damage.

Key requirements include:

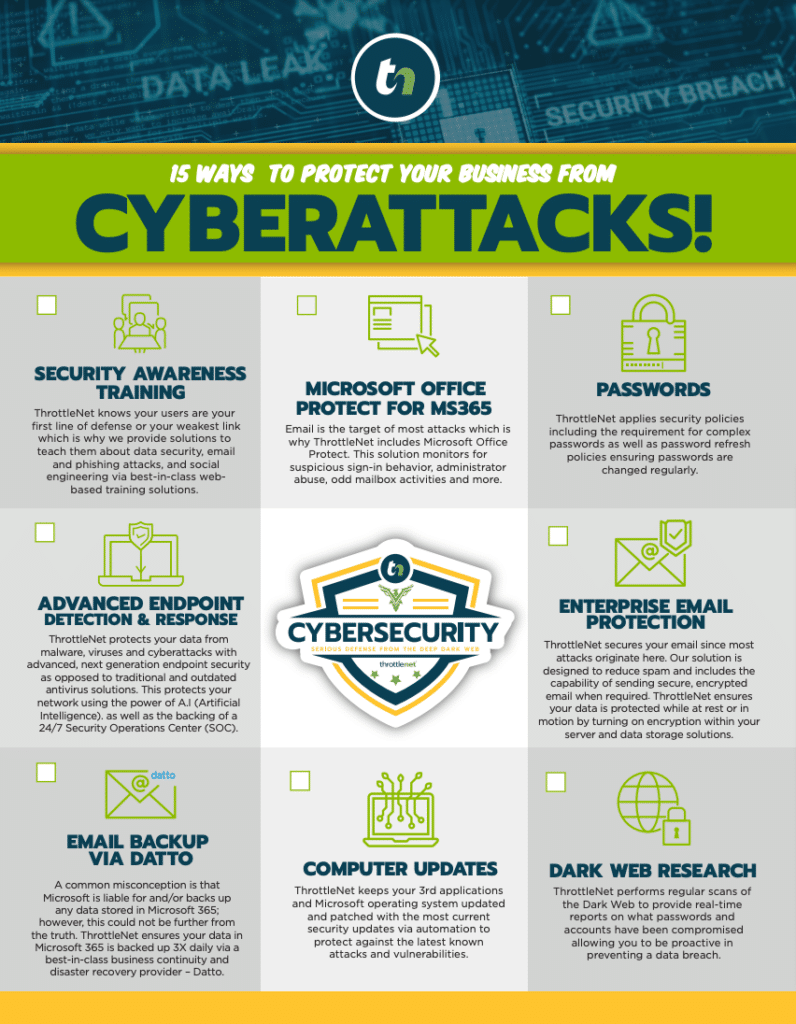

- Multi-Factor Authentication (MFA): Insurers mandate MFA to ensure that access to sensitive systems requires multiple forms of verification, significantly reducing unauthorized access risks.

- Offsite (Cloud) Backups: Maintaining cloud backups that are isolated from local network connections ensures data recovery capabilities in the event of ransomware attacks or data corruption.

- Managed Detection and Response (MDR): Implementing advanced MDR solutions enables continuous monitoring and response to threats across all endpoints, enhancing overall security posture. This also ensures that any threats or false positives are reviewed by a 24/7 Security Operations Center (SOC) to determine the required action.

- Regular Patching and Vulnerability Management: Timely application of security patches and proactive management of vulnerabilities are critical in preventing exploitation by threat actors.

- Security Awareness Training: The weakest link in any network chain is often the user. Educating employees about cybersecurity best practices and threat recognition is essential, as human error remains a leading cause of breaches.

Best Practices for Meeting Cyber Insurance Criteria

To align with insurer expectations and strengthen your organization’s defenses—especially if you’re seeking cyber insurance for small businesses—consider the following strategies:

- Adopt Recognized Cybersecurity Frameworks: Implementing standards such as the National Institute of Standards and Technology (NIST) Cybersecurity Framework (CSF) demonstrates a commitment to structured security practices, potentially leading to premium reductions.

- Develop a Comprehensive Incident Response Plan: Having a well-defined plan ensures preparedness for potential breaches, showcasing to insurers your capability to manage and mitigate incidents effectively.

- Implement a Zero Trust Architecture: This security model operates on the principle of “never trust, always verify,” ensuring strict access controls and minimizing potential attack vectors.

- Conduct Regular Penetration Testing or External Vulnerability Scans: Engaging third-party experts to assess system vulnerabilities helps in identifying and addressing security gaps, thereby reducing risk profiles.

Strategies to Lower Cyber Insurance Premiums While Increasing Security

Note we said while increasing security, because this should be the true driving factor—with the result being lower premiums. For those exploring cyber insurance for small businesses, this approach ensures that you always have the proper controls in place and that they are not being driven solely by minimum insurance requirements.

By enhancing your cybersecurity measures, you can positively influence insurance costs:

- Enhance Data Protection Measures: Implementing robust data encryption and secure handling practices can reduce the risk of data breaches, leading to potential premium discounts.

- Invest in Advanced Threat Detection Systems: Utilizing AI and automation in security operations can improve threat detection and response times, making your organization a lower risk for insurers. These include solutions such as SentinelOne for networks or spam filters for email protection.

- Maintain Comprehensive Documentation: Keeping detailed records of security policies, incident response plans, assets, applications, and compliance audits demonstrates a proactive security posture to insurers.

- Engage in Continuous Employee Training: Regular cybersecurity training programs for employees can prevent incidents caused by human error, thereby reducing claim likelihood and insurance costs.

Navigating the cyber insurance landscape requires a proactive approach to cybersecurity. For organizations seeking cyber insurance for small businesses, understanding and implementing the necessary requirements and best practices is key. Not only will this help qualify for coverage, but it can also lead to reduced premiums. Investing in robust security measures today is a strategic move that safeguards your organization’s future and positions you for long-term success in an increasingly digital world.

Chris Montgomery

ThrottleNet Sales Director

cmontgomery@throttlenet.com