In recent years, cyber insurance companies have become one of the most important lines of defense against cyberattacks.

How Essential is Cyber Insurance?

Cyber insurance is as essential to businesses as health insurance. As businesses become increasingly digitized, the risk of a cyberattack grows. Cyber insurance can help businesses recover from a data breach or other cyberattack.

The cost of cyber insurance depends on a variety of factors, including:

- type of business

- number of employees

- annual revenue

- industry of the business

- current cybersecurity efforts

- history of cybersecurity breaches

As the price of coverage has dropped over time, more businesses are now purchasing cyber insurance.

In fact, according to a 2018 report from the Software & Information Industry Association, 61 percent of companies currently have some form of cyber insurance.

What to Keep In Mind

When it comes to buying cyber insurance policies, businesses need to be smart and do their research. Not all policies are created equal, and businesses need to make sure they are getting the coverage they need.

For Companies That Already Have a Policy

Businesses need to stay up-to-date on their cyber insurance policy to ensure they are getting the most coverage possible. In the case of an attack, businesses need to be aware of what is and isn’t covered by their policy.

For example, some policies may cover the costs of notifying individuals impacted by a data breach, while others may not.

Companies that have insurance before the pandemic or obtained coverage during the outbreak should prepare for its renewal and ensure they are following advised security procedures.

Unfortunately, making changes to security systems is not something that businesses can accomplish overnight. To establish these security measures, organizations must have a project plan in place. Insurers will not provide firms with the roadmap for implementing these security methods, so they must be prepared to do it on their own.

For Companies Buying Cyber Insurance for the First Time

Companies should thoroughly examine the specifics of potential insurance plans and ensure that the terms and conditions meet the specific and unique needs of your business.

When it comes to receiving payment on claims, pay attention to the requirements for recovering from a breach as well as data backup requirements and claim payout conditions.

After a data breach, organizations have to demonstrate the impact of the breach or that it fulfills security controls requirements. This is similar to health insurance where patients must show that they fulfill the criteria for treatment. If you are unable to produce enough evidence, your business could be forced to pay out of pocket.

When insurance companies increase security standards, they usually do so with claims requirements. Insurers want documentation that the event is covered under their cyber insurance policy and that it is an issue that is truly covered.

The Importance of Risk Assessments

A risk assessment is important for businesses to have because it allows them to identify their cybersecurity risks. This information is important for businesses when it comes to purchasing cyber insurance.

Cyber insurance companies will often require a risk assessment before providing a policy, and the results of that assessment can help businesses determine their coverage needs.

Risk assessments should be conducted regularly, as the risks associated with cybersecurity change over time. Businesses should also involve cybersecurity experts in their risk assessment process. This expert can help identify vulnerabilities and provide advice on how to reduce the risk of a cyberattack.

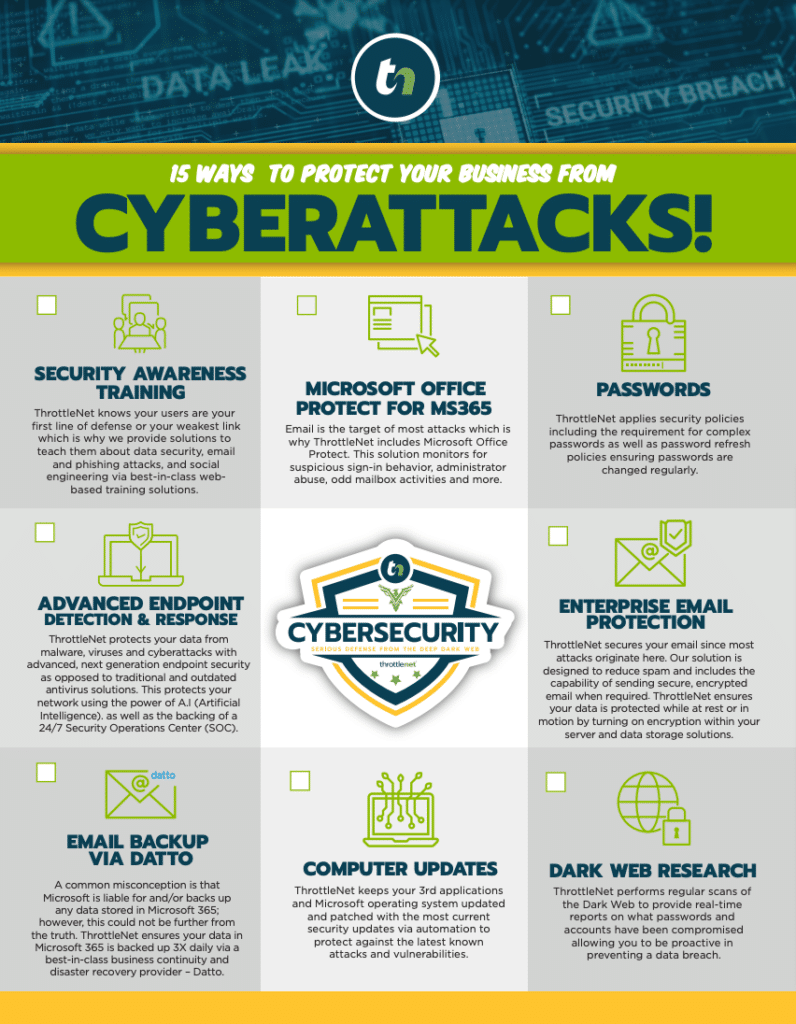

If you’re a business looking for help with your risk assessments, or any other aspect of your cybersecurity, please contact ThrottleNet. We have over 20 years of experience in the cybersecurity industry, and we can help you protect your business from cyberattacks.

For more information, contact us today.