Cybersecurity Claims Can Be Denied With Improper Information.

Cybersecurity insurance is complex and must be filled out correctly for proper protection. If you submit the forms with improper answers, you may be paying a high cost for something that doesn’t protect you. Whether you’re a small startup or a large enterprise, the potential for cyber-attacks is a real and ever-present danger. Do you have the right safeguards in place to lower your insurance costs? Will you be denied coverage because you didn’t understand the question and answered it incorrectly?

With cybercrime increasing in both frequency and sophistication, cybersecurity insurance has become an essential tool for protecting businesses from the financial fallout of a breach. However, obtaining the right coverage isn’t as simple as purchasing a policy. The complexities involved in filling your cybersecurity insurance form can be overwhelming for businesses without a cybersecurity expert. This is where ThrottleNet steps in.

At ThrottleNet, we understand that cybersecurity insurance is not a one-size-fits-all solution. The intricacies of different policies, coupled with evolving cybersecurity regulations, make it challenging for businesses to find the right coverage that meets both their needs and compliance requirements. Our team specializes in helping businesses not only secure comprehensive cybersecurity insurance but also ensure they have the necessary protections in place to qualify for coverage. Here’s how we help:

1. Assessing Your Risk Profile

Insurance providers assess risk before offering coverage, and cybersecurity insurance is no different. To help businesses secure the best possible policy, ThrottleNet begins by conducting a thorough assessment of your current cybersecurity posture.

We look at:

- Your existing security infrastructure.

- Data privacy and management practices.

- Vulnerabilities and previous incidents.

- How your business handles sensitive customer information.

This risk assessment gives us a clear picture of where your business stands and helps us identify gaps that could hinder your ability to secure affordable cybersecurity insurance.

2. Fulfilling Policy Requirements

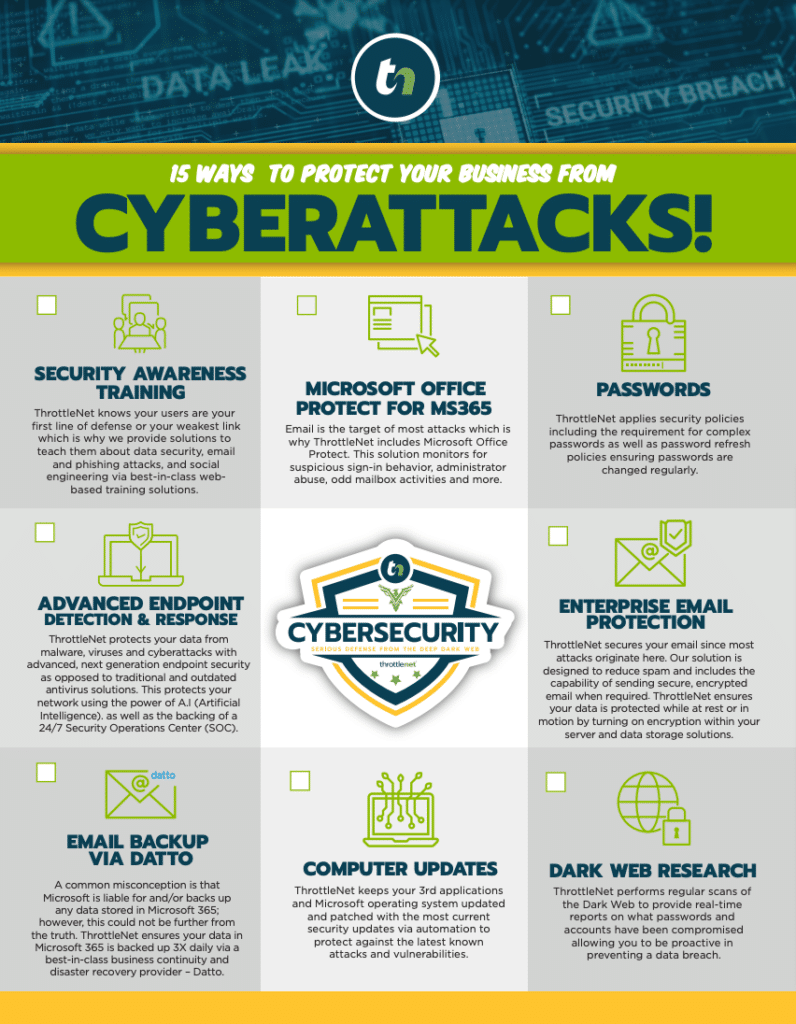

Cybersecurity insurance policies typically come with a range of requirements that businesses must meet before they are eligible for coverage. These include implementing security measures such as firewalls, data encryption, endpoint protection, and regular employee training on cybersecurity best practices.

ThrottleNet works with your business to ensure these essential measures are in place. Our Managed Security Services provide the comprehensive protection needed to satisfy insurance providers’ standards. We offer:

- 24/7 Network Monitoring to detect and respond to threats in real time.

- Endpoint Detection and Response (EDR) to safeguard your devices against malware, ransomware, and other malicious activities.

- Regular System Updates and Patch Management to close vulnerabilities before they can be exploited.

- Security Awareness Training for your staff to mitigate human error, which is often the weakest link in a business’s defense.

By fortifying your systems and practices, ThrottleNet helps businesses meet or exceed the criteria set by cybersecurity insurance policies, ensuring you’re eligible for the best coverage at competitive rates.

3. Ensuring Compliance with Industry Standards

Many industries—such as healthcare, finance, and legal—have strict cybersecurity regulations they must adhere to, like HIPAA, PCI-DSS, and GDPR. Failing to meet these compliance requirements can lead to increased insurance premiums or even denial of coverage.

ThrottleNet takes the headache out of compliance by ensuring that your business meets the necessary regulatory requirements. Through our compliance-focused cybersecurity solutions, we help you navigate these complex regulations, ensuring that your business remains protected both legally and financially. Our team stays up-to-date with changes in industry standards so that your compliance efforts are always current, avoiding potential penalties and boosting your insurance eligibility.

4. Lowering Premiums Through Risk Mitigation

A comprehensive cybersecurity strategy doesn’t just help you qualify for insurance—it can also help lower your premiums. Insurance providers reward businesses that take proactive steps to reduce their risk of a breach. By partnering with ThrottleNet, you demonstrate to insurance companies that your business is serious about cybersecurity and has implemented top-tier defenses against potential threats.

Our proactive approach to cybersecurity includes regular risk assessments, penetration testing, and vulnerability scanning. This ongoing vigilance helps prevent breaches, which can, in turn, reduce the likelihood of filing a claim—leading to lower premiums and a better overall insurance experience.

5. Support During the Claim Process

In the unfortunate event of a cyber incident, navigating the insurance claim process can be daunting. ThrottleNet doesn’t just help you prepare for cyber threats—we’re also there to support you in the aftermath. If you experience a breach, our Incident Response Team works swiftly to contain the damage, recover lost data, and get your business back online as quickly as possible.

Simultaneously, we assist with the insurance claim process by documenting the incident, gathering evidence, and providing the necessary information to your insurer. This reduces the time and complexity involved in filing a claim, ensuring a smoother process during an already stressful time.

6. Tailored Solutions for Your Business

At ThrottleNet, we understand that every business is unique, and so are their cybersecurity needs. We don’t believe in cookie-cutter solutions. Instead, we offer customized security strategies tailored to fit the specific demands of your business, your industry, and your risk profile. This means that whether you’re seeking coverage for data breaches, ransomware attacks, or third-party vendor risks, we can help you find a policy that covers all your bases.

Cybersecurity insurance is more important than ever, but it’s not something businesses should navigate alone. From understanding policy requirements to implementing the right security measures, there’s a lot that goes into obtaining comprehensive coverage. ThrottleNet is your trusted partner in this journey. We ensure that your business is not only well-protected against cyber threats but also prepared to meet the demands of the insurance industry.

With ThrottleNet by your side, you can focus on growing your business, knowing that your cybersecurity insurance is aligned with your needs and that your systems are equipped to handle the threats of today and tomorrow. Let us help you take the guesswork out of cybersecurity insurance, so you can rest easy knowing you’re fully protected.

Jake Price

Marketing & Business Development Coordinator

jprice@throttenet.com