The accounting industry is always changing. In order to stay competitive, accounting firms need to embrace digital transformation. What is digital transformation? Simply put, it is the process of adapting to a digital world. This includes using technology to improve performance and agility.

Many benefits of embracing new technologies include improved efficiency, better customer service, and increased competitiveness. Digital transformation can also help accounting firms become more agile and responsive to change.

If you’re not sure where to start, don’t worry! We will outline some steps that you can take in order to get started on your own journey toward digital transformation.

What Is Digital Transformation?

The first step is understanding what digital transformation is and how it can help your accounting firm evolve. To summarize quickly; Digital transformation entails significant changes to an organization’s use and application of technology. It’s the process of adapting to a rapidly-changing digital world. This allows financial organizations to use technology to improve performance and agility.

Digital transformation also includes changes to the way you do business. For example, you may need to change the way you communicate with clients or the way you store data. The goal of digital transformation is to help your accounting firm become more efficient, agile, secure, and responsive to change.

The Benefits of Embracing Digital Transformation

There are many benefits of digital transformation, but we wanted to focus on a few that are particularly relevant to the accounting industry.

- Improved Efficiency: Adapting to AI allows accountants and CPAs to automate time-consuming tasks. By automating you are able to streamline processes, freeing time up for your team to focus on more critical tasks.

- Increased Sustainability: Organizations that leverage the potential of digital innovation are able to meet their sustainability goals quicker and typically in a more cost-effective way.

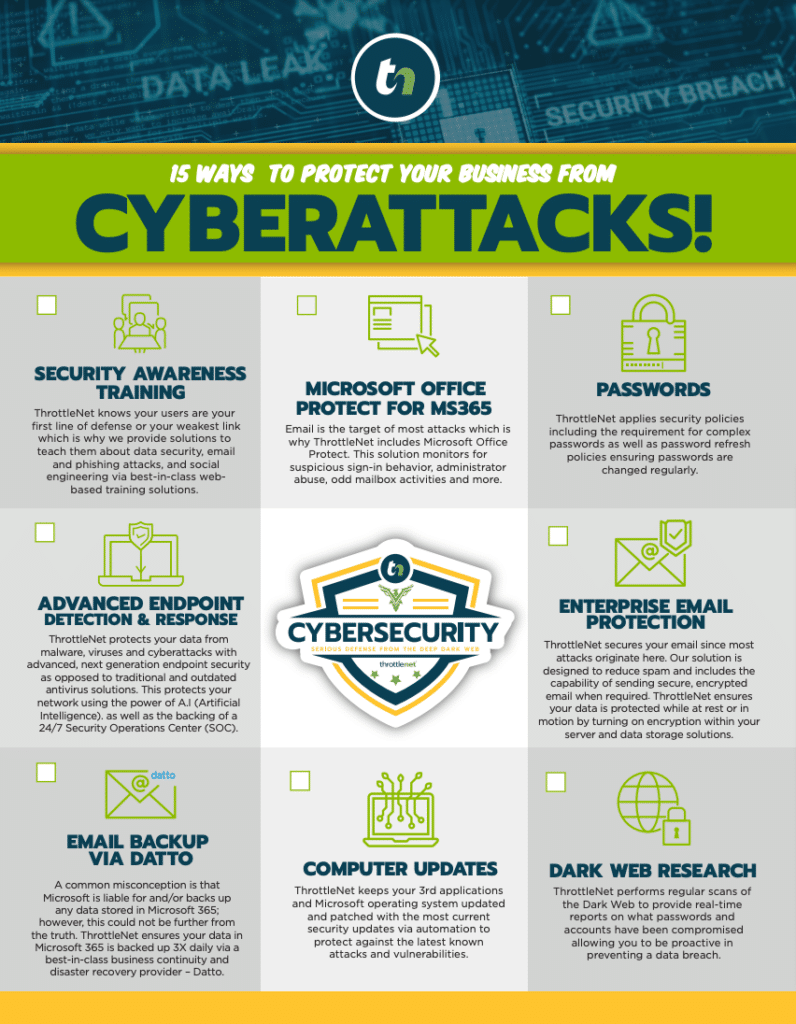

- Establish a Cybersecurity Culture: Financial Firms that equip their employees with security awareness training and knowledge necessary to improve cyber hygiene are better equipped to identify security threats, such as phishing attempts.

- Better Customer Service: New technology can also help you improve your customer service. By using technology to automate tasks and keep track of customer data, you can provide a better experience for your clients.

- Increased Competitiveness: Transforming your technology can help you stay ahead of the curve and remain competitive in the accounting industry. By embracing new technologies, you can offer new services and capabilities that your competitors may not be able to match.

How ThrottleNet Can Help You Get Started

Now that you know more about embracing new technology and how it can help your accounting firm, you may be wondering how to get started.

There are a few steps that you can take to get started on your own journey toward digital transformation. Don’t worry if you’re not sure where to start, we can help. We specialize in helping accounting firms embrace technology and improve their cyber resiliency. Contact us today to learn more about how we can help you on your journey.