Will Your Cybersecurity Insurance Be Denied? In today’s digital landscape, cyber threats are more prevalent than ever and cyber insurance is ever more confusing. As businesses increasingly rely on technology, the risks associated with cyberattacks, data breaches, and other digital threats have surged. This is why it is important to get your cybersecurity insurance right. But what is cybersecurity insurance, how do you break through the confusion, and why is it essential for businesses of all sizes? Let’s explore the what, why, and how of cybersecurity insurance, along with expert advice on securing your business.

What is Cybersecurity Insurance?

Cybersecurity insurance, also known as cyber insurance, is a policy designed to help businesses mitigate the financial impact of cyber incidents. This type of insurance covers expenses related to data breaches, ransomware attacks, business email compromise (BEC), regulatory fines, legal fees, and more. It is not a replacement for robust cybersecurity measures but rather a safety net that helps businesses recover from digital disasters.

Types of Coverage

First-Party Coverage: Protects businesses from direct losses such as data recovery, business interruption, and cyber extortion payments.

Third-Party Coverage: Covers liability costs if customer or partner data is exposed due to a breach.

However, it’s essential to understand that cyber insurance policies have limitations and exclusions. Unpatched systems, employee negligence, and certain types of attacks may not be covered. Therefore, businesses must carefully review their policies and ensure they meet all security requirements.

Why is Cybersecurity Insurance Important?

The importance of cybersecurity insurance cannot be overstated. With cybercrime on the rise, businesses face increasing risks of financial loss, repetitional damage, and operational disruptions. Cyber insurance provides a crucial layer of protection, covering costs that could otherwise cripple a business.

Many businesses assume their policies cover everything, but the fine print matters. Cyber insurance is not a substitute for cybersecurity; it’s a complement to it. Businesses must implement strong security measures to not only qualify for coverage but also ensure their claims are honored in the event of an incident. Many companies can be denied for unknowingly answering a question wrong on their forms. We can help!

Current Trends Affecting Cyber Insurance Policies

Cyber insurance is evolving rapidly due to rising cybercrime rates. Premiums have surged as insurers pay out more claims, and underwriting processes have become more stringent. Insurers now require businesses to demonstrate robust cybersecurity measures such as Multi-Factor Authentication (MFA), Endpoint Detection & Response (EDR), and secure backups.

AI-powered cyberattacks are also shaping the future of cyber insurance. Insurers may start excluding coverage for AI-driven attacks or demand more rigorous verification methods. Businesses must stay ahead of these trends to remain insurable and manage costs effectively.

What Businesses Need to Qualify for Cyber Insurance

To qualify for cyber insurance, businesses must meet specific security requirements, including:

- Multi-Factor Authentication (MFA)

- Endpoint Detection & Response (EDR)

- Secure, offsite, and immutable backups

- Regular employee security training

- Documented incident response and disaster recovery plans

Failing to meet these requirements can lead to denied coverage, higher premiums, or claim rejections.

How ThrottleNet Helps Businesses Navigate Cyber Insurance

ThrottleNet offers comprehensive support to businesses seeking cyber insurance. From guiding them through the application process to implementing necessary security controls, ThrottleNet ensures businesses are well-prepared.

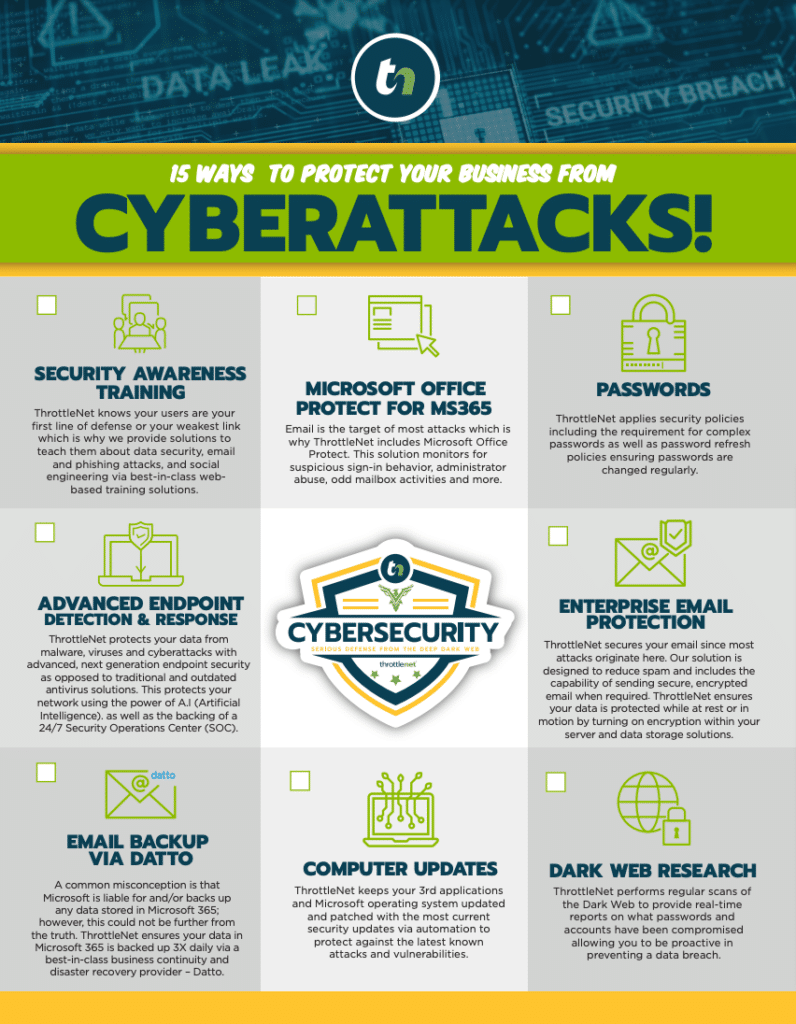

ThrottleNet’s Cybersecurity Protection Program provides cutting-edge security solutions tailored to each business’s unique needs. Our services include 24/7 threat detection and response, managed firewalls, endpoint protection, network monitoring, vulnerability assessments, and advanced email security. This robust program ensures businesses not only meet cyber insurance requirements but also enhance their overall cybersecurity posture.

ThrottleNet assists with:

- Completing security questionnaires accurately

- Providing documentation for insurers

- Implementing MFA, EDR, email security, and secure backups

- Developing cybersecurity policies and incident response plans

- Offering post-breach support and claim assistance

Cybersecurity insurance is essential for protecting businesses in the digital age. However, obtaining and maintaining coverage requires more than just purchasing a policy. Businesses must implement strong cybersecurity practices and stay informed about evolving threats and insurance requirements. ThrottleNet’s Cybersecurity Protection Program ensures businesses are not only insured but also secure. Now that we’ve answered the question, “what is cybersecurity insurance?” contact ThrottleNet today to learn more about how to protect your business from cyber threats.

Jake Price

Marketing & Business Development Assistant

jprice@throttlenet.com