Although there’s no specific time of year that cyber liability renewals happen, a fair number occur this time of year due to fiscal year-end and budgets coming due. Due to this, we get a number of questions from our clients about how to fill out these forms and what information is required to do so.

What’s interesting is that each carrier seems to have a different opinion on what is required to insure someone as well as what questions they ask to make this determination. For example, some forms may be a single page with a couple of questions whereas others could have as many as three pages and well over 30 questions – with no explanation around why the differences exist.

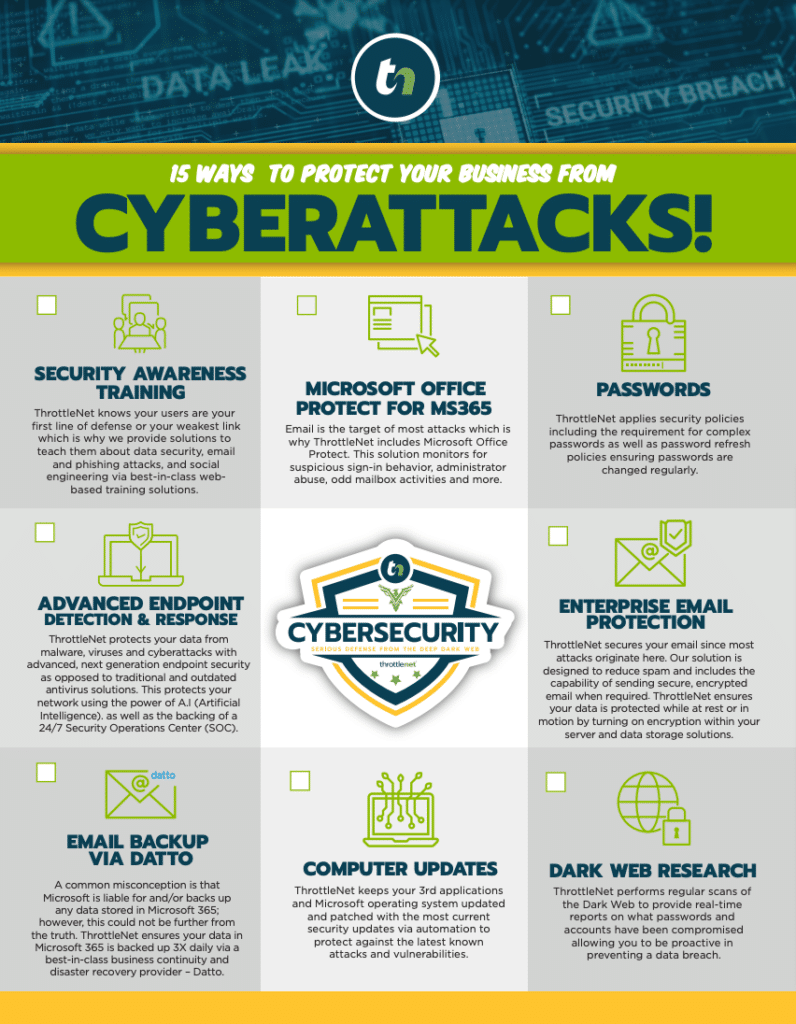

Regardless, there are some requirements we find to be consistent across most organizations and carriers including, but not limited to, the requirement for multifactor authentication (MFA), some form of user education and training, and enterprise-grade firewall technology to name a few.

Given the importance of cyber liability coverage as well as the different variations of questionnaires, it is imperative that these are accurate and that no assumptions are made without confirming them first. The reason this is so important should go without saying; however, for those who need to hear it – an incorrect or incomplete questionnaire can lead to severe consequences, especially if you need to file a claim after an attack.

Why Filling Out Your Cyber Liability Form Accurately Matters

It is critically important that you accurately fill out your cyber liability in the unfortunate event of a cyberattack. Doing so is one of the best ways you can protect your business. Here are some of the top considerations you should know.

Underwriting Process

The underwriting process is the insurer’s method of evaluating risk before offering coverage. The information provided on a cyber liability insurance form is used to assess your company’s cybersecurity posture. This includes your current cybersecurity policies, technologies, compliance with legal regulations, incident response plans, and even past cyber incidents. If this information is incomplete or inaccurate, it skews the insurer’s ability to gauge your risk accurately. This can lead to insufficient coverage, higher premiums, or in some cases, a denial of coverage altogether.

For example, if a company fails to disclose its use of outdated software or weak encryption protocols, an insurer might underwrite the policy under false assumptions, resulting in incorrect coverage limits or exclusions.

Claim Denials

The most significant consequence of an incomplete or inaccurate cyber liability form is the potential denial of claims. If a cyberattack occurs, and it is later discovered that key details were omitted or misrepresented during the application process, the insurer may refuse to cover the claim. Insurance companies can argue that the misrepresented information would have changed the terms of coverage or led to the application being denied from the outset.

For instance, if you falsely claim to have multi-factor authentication (MFA) enabled across all systems but, in reality, do not, this could be grounds for the insurer to deny a claim in the event of a breach resulting from weak access controls.

Legal and Financial Ramifications

Inaccurate or incomplete information on your cyber liability form can also expose your business to legal challenges. If the insurer denies coverage due to misrepresentation or omission, your company could face significant out-of-pocket expenses for legal fees, settlements, and recovery efforts. This can lead to devastating financial losses, especially for small or medium-sized businesses that may not have the resources to absorb such costs.

Furthermore, if the misrepresentation is deemed intentional, it could even lead to accusations of fraud, resulting in legal penalties or blacklisting by other insurers.

The Impacts of Neglecting Key Information

Underinsurance

One of the immediate risks of not fully disclosing your cybersecurity infrastructure and practices is being underinsured. If you fail to provide a full scope of your digital assets, the insurer may provide a policy with lower coverage limits than needed. In the event of a cyber incident, you may find that the policy only covers a fraction of the damages, leaving your company responsible for the rest.

Exclusion of Key Coverage Areas

Inaccuracies or omissions in your application may lead to coverage exclusions for specific incidents or vulnerabilities. For example, if your company does not disclose that it stores sensitive personal data, the insurer may exclude coverage for breaches involving personally identifiable information (PII), leaving your business unprotected in such an event.

Higher Premiums Down the Line

Even if your application is accepted despite inaccuracies, your insurer may reassess the risk after a claim is made. If they discover that the original application contained missing or misleading information, they could hike up your premiums during renewal, citing the increased risk. This could result in your business paying more for coverage, as well as damage to your standing with that insurer and others.

Increased Vulnerability to Cyber Threats

The process of filling out a cyber liability insurance form often forces businesses to conduct a self-assessment of their cybersecurity practices. By failing to provide complete or accurate information, you may overlook significant vulnerabilities in your own systems. Neglecting to disclose—or even assess—key aspects of your security infrastructure could lead to a false sense of protection, making your company a more attractive target for cybercriminals.

How to Avoid These Issues

To avoid the pitfalls of incomplete or inaccurate cyber liability insurance forms, businesses should adopt a proactive approach:

- Conduct a thorough cybersecurity audit before filling out the form. This will help identify any weak spots and provide a clear understanding of your current security posture.

- Engage with a qualified broker or legal counsel who specializes in cyber insurance. They can guide you through the form and ensure you accurately represent your risks.

- Be transparent about your cybersecurity practices. Even if you have areas that need improvement, it’s better to disclose them and work with your insurer to address these issues than to risk policy denial later.

- Review and update your cybersecurity measures regularly. Insurers want to see that you are taking active steps to mitigate risks. Regularly updating your systems, protocols, and policies will not only enhance your security but also ensure more favorable insurance terms.

Filling out your cyber liability insurance form accurately and thoroughly is more than just a procedural task—it’s a critical step in establishing sound cybersecurity to protect your business from the growing risk of cyber incidents. Failing to provide complete and accurate information can result in claim denials, higher premiums, legal challenges, and underinsurance. To avoid these risks, it’s essential to engage in a thorough self-assessment, consult with experts, and prioritize transparency with your insurer.

Contact us at ThrottleNet for help!

Chris Montgomery

ThrottleNet Sales Director

cmontgomery@throttlenet.com