In an age with excessive digital crime, where data breaches and cyber attacks have become prevalent, financial services companies face a growing need for robust cyber security protocols. These organizations handle vast amounts of sensitive client information, making them prime targets for cybercriminals.

This article explores the reasons why financial services cyber security is required for companies so they can protect valuable data, and the role of managed IT companies in bolstering these cyber security efforts.

The Growing Need for Strong Cyber Security Protocols

Financial services companies deal with an extensive range of sensitive information, including personal identification data, financial records, and confidential transactions. As a result, they are attractive targets for cyber criminals seeking to gain unauthorized access to this valuable data.

The repercussions of a successful attack can be severe, including:

- Financial loss

- Reputational damage

- Regulatory penalties

- Legal liabilities

Implementing robust financial services cyber security is essential to mitigate the risks associated with data breaches to protect the interests of clients and companies alike.

Ensuring Necessary Steps to Protect Sensitive Information

1. Data Encryption and Access Control

Financial services companies must prioritize data encryption to safeguard client information. Encryption converts data into an unreadable format, rendering it useless to unauthorized individuals who may intercept it. Implementing strong access control mechanisms, such as multi-factor authentication, can also limit access to sensitive data to authorized personnel only, reducing the likelihood of data breaches.

2. Regular Software Updates and Patch Management

Keeping software and systems up-to-date is crucial for addressing vulnerabilities and weaknesses that can be exploited by cybercriminals.

Financial services companies should establish comprehensive patch management procedures to ensure that all software and systems are promptly updated with the latest security patches and fixes. This minimizes the risk of cyberattacks exploiting known vulnerabilities.

3. Employee Training and Awareness

Human error remains a significant factor in cyber security incidents. Financial services companies must provide comprehensive training and awareness programs for employees, emphasizing the importance of strong passwords, recognizing phishing attempts, and following secure practices.

Regular training sessions and simulated phishing exercises can help reinforce cyber security best practices and foster a culture of security awareness within the organization.

4. Incident Response and Disaster Recovery Planning

Despite the best preventive measures, cyber incidents may still occur. Financial services companies should have well-defined incident response and disaster recovery plans in place.

These plans outline the steps to be taken in the event of a breach, including containment, investigation, communication, and recovery. By having a structured and tested incident response plan, companies can minimize the impact of a cyber attack and swiftly recover operations.

The Role of Managed IT Companies

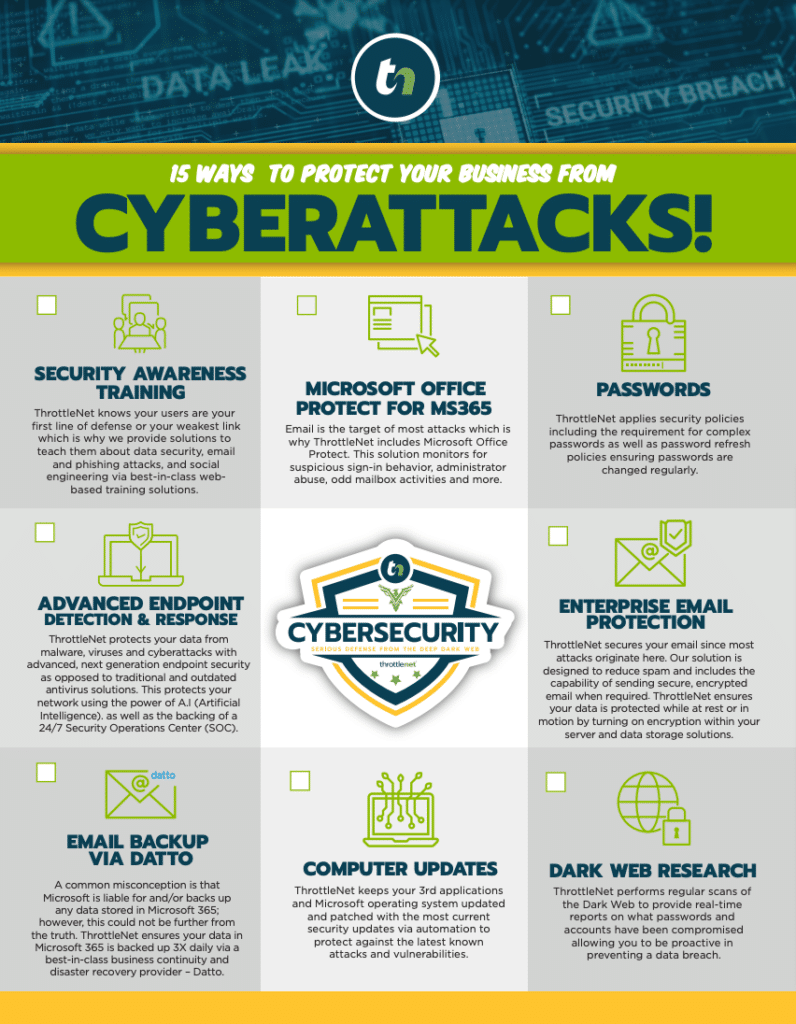

Managed IT service providers, such as ThrottleNet, specialize in offering comprehensive cyber security solutions tailored to the needs of financial services companies. These companies have the expertise and resources to handle complex security systems, allowing financial organizations to focus on their core competencies.

Managed IT service providers offer proactive monitoring, threat detection, vulnerability assessments, and incident response services. By partnering with a managed IT company, financial services companies can leverage advanced security technologies and gain access to a team of dedicated cyber security professionals.

ThrottleNet Can Help

In the face of increasing cyber security risks, financial services companies cannot afford to overlook the importance of robust cyber security protocols. By implementing comprehensive security measures and partnering with managed IT service providers, these companies can significantly reduce the risk of data breaches and cyber attacks.

For comprehensive cyber security solutions designed specifically for financial services companies, partner with ThrottleNet. Visit our website to learn more about our specialized services, advanced technologies, and dedicated team of cyber security experts.